Even in "regular" financial markets, performing Fundamental Analysis on listed stocks and bonds can often be tricky. Information is only released by corporations on a quarterly (or less!) basis and numbers are often subject to significant massaging by management.

The goal of Fundamental Analysis is essentially to determine the Intrinsic Value of a corporation, so as to identify situations where an investor can potentially purchase $1 in value for less than $1 in price on the open market. This kind of investing can be classified as a concave trading strategy in the world of Dynamic Asset Allocation.

As noted above, this kind of work can be tricky and investor returns will often be largely dependent on how informed the investor is (i.e. is their calculation of Intrinsic Value based on the same public information available to all investors?) and how many other investors are in the market pursuing similar or the same strategies (thus reducing returns by increasing local efficiency in the market).

On top of this, often inexperienced investors who think they are applying correct Fundamental Analysis, label it as nonsense after the market doesn't reward their analysis (rather than recognising their analysis must have been incorrect or not totally informed).

Well if Fundamental Analysis is so tricky and the returns are so fickle, why are we talking about it? Because, as it turns out, you can use various equations of Intrinsic Value, not to determine it but rather to determine what the market is implying (i.e. forecasting) the future prospects of a given asset may be.

One equation that I particularly like for this task is a "P/E fair value" model proposed by Vitaliy Katsenelson in his book Active Value Investing which I have abbreviated as:

Base IV P/E = 8 + DividendYield + (0.65 * EPS Growth)

If you're unfamiliar with the Price/Earnings ratio, please research before continuing. Premium can be added (maximum 30%) or subtracted (no maximum) to account for Business Risk, Financial Risk and Earnings Visibility. In cases where EPS growth is above 17%, a lower delta is applied (0.5 instead of 0.65). The "starting P/E" of 8 equates to an earnings yield of 12.5% (earnings yield is P/E inverted 1/8) and is supposed to represent an earnings yield that would be attractive to any investor for any security.

For a quick exercise to show how the equation works, let's try and value the S&P500 (using NYSE:SPY as a proxy). Because it consists of above, at and below average businesses, we can assume no premium to be added or subtracted in valuing the index.

For the purposes of this example we will use the peak-to-peak long term EPS growth of 6.5%/p.a.

SPY IV P/E = 8 + 1.88 + (0.65 * 6.5) = 14.105

Now with a current P/E ratio of 15, we can calculate SPY as slightly overvalued. As you can see our IV calculation is extremely dependent on how valid our estimate of EPS growth and dividend yield are. If EPS growth is only 2% for the next 10 years then it's very likely our investment will underperform relative to what we calculated! Conversely, if we didn't invest and then it turns out EPS growth was 10% for the next 10 years, we will have missed out on an undervalued investment.

Alright, now that we have those basics under our belt, why don't we try to work backwards with this equation and try to figure out what the market is forecasting through its current pricing of S.MPOE. I've used the data from BTCAlpha for this exercise.

In this case, the number of assumptions we need to make is very small: one. We just assume (for the sake of experiment) that the market price of S.MPOE is efficient, i.e. that the current price represents something close to Intrinsic Value. Thus, we can calculate what the current price implies the market is forecasting EPS growth to be.

Remember I mentioned above that in cases of EPS growth above 17% we need to grade the deltas to a lower level (0.5) and a company can potentially be awarded a 30% premium over base if the investor thinks it appropriate.

96.4 = [ 8 + 1.0 + (0.65 * EPSGrowthBelow17%) + (0.5 * EPSGrowthAbove17%) ] * Premium

Some quick maths shows that the "Market Implied EPS Growth" must be greater than 17% since even in the highest case and assigning a full premium, the P/E calculation only comes out as 20 to 26, e.g.

[ 8 + 1.0 + (0.65 * 17) ] = 20.05

[ 8 + 1.0 + (0.65 * 17) ] * (0.3 * 20.05) = 26.065

These numbers are far below the actual P/E of 96.4! So the implied growth must be much higher!

[ 8 + 1.0 + (0.65 * 17) + (0.5 * 152.7) ] = 96.4

or if we provide

S.MPOE with the full premium associated with a business that has perfect

Earnings Visibility and 0 Earnings or Business Risk:

[ 8 + 1.0 + (0.65 * 17) + (0.5 * 108.5) ] = 74.3

[ 8 + 1.0 + (0.65 * 17) + (0.5 * 108.5) ] * (0.3 * 74.3) ~= 96.4

So we can see that based on the current price, even with the premium for a perfect business, that the Market Implied EPS Growth rate for S.MPOE is very, very high.

We are talking a range of 126% - 170% here. This premium over normal fair values (compare to our earlier SPY example) assigned by the market under assumptions that EPS growth will be very large. Investors who pay the premium today will be rewarded with reasonable returns only if the actual future EPS growth averages at or above this level for a significant period of time. Otherwise the investment can reasonably be expected to provide a poor long term return at current prices.

One thing to note is that I am basing all these calculations on the assumption of "Bitcoin Economy". That is to say, we are not interested in the BTCUSD exchange rate as a source of returns in this equation.

This posting took about two hours to compile and write. If you found it interesting and would like to encourage more postings of similar stuff, consider a 2h*BTC donation to

1CcaDNd7mso6PcCHLitZXGeRNdrCJrgx7u

bitquant

Monday, February 17, 2014

Sunday, February 2, 2014

Just-Dice Kelly Criterion Sensitivity Analysis

Out of curiosity I've been collecting trade data on the MPex listed stock MPOE to see how the kinds of analysis I might like to do on a regular listed stock would look on a bitcoin exchange listed stock.

While showing some very preliminary graphs to the people in #bitcoin-assets, one of them mentioned I should apply some analysis to the betting website just-dice. (See here for discussion)

The proper place for prospective betters with a quantitative bent is generally to start with the Kelly Criterion, described by Wikipedia as follows:

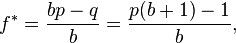

Where

p = Probability of winning

b = Net profit from a winning bet

Wikipedia also notes that if the equation returns a zero value the optimal bet is no bet and if a negative value is obtained then the prospective better should (if possible) take the other side of the bet.

Unfortunately this option isn't available for the just-dice website (making it more of a game than risk market) so before analysis even begins we already know just-dice is potentially not a good place to place bets (note on this at the end).

But let's push on and see what kind of numbers we get for the various values of p and b. This is a crude sensitivity analysis just to see if the data tells any obvious stories, the just-dice site should be commended for making a very nice betting site which is quite transparent in terms of showing you the parameters of each bet.

The analysis shows that there isn't much point pressing deeper into the data as it's doubtful we will see a positive f* value and as I mentioned earlier we cannot take the other side of these bets in the game.

Note: One cool thing about just-dice is that they allow you to "invest" in the house, i.e. your bitcoins get exposure to the house edge (according to their website, currently limited at 0.5% of the total 1% if my reading is correct).

The sensitivity analysis shows that for the chosen (and likely all possible) probabilities, the optimal bet is to take the house side of the bet, so the only optimal bet is to invest. Anyone playing the game should view it as a crapshoot or hobby at best.

The topic of when to invest in just-dice and when to withdraw is obviously an interesting one of itself and might form the topic of a later blog post, leave a comment if you'd be interested.

It took me about 1.5 hours to sail about the just-dice website, collate data and write this blog post. If you found it interesting and would like to encourage more postings of similar stuff, consider a 1.5h*BTC donation to

1CcaDNd7mso6PcCHLitZXGeRNdrCJrgx7u

While showing some very preliminary graphs to the people in #bitcoin-assets, one of them mentioned I should apply some analysis to the betting website just-dice. (See here for discussion)

The proper place for prospective betters with a quantitative bent is generally to start with the Kelly Criterion, described by Wikipedia as follows:

- In probability theory and intertemporal portfolio choice, the Kelly criterion, Kelly strategy, Kelly formula, or Kelly bet, is a formula used to determine the optimal size of a series of bets. In most gambling scenarios, and some investing scenarios under some simplifying assumptions, the Kelly strategy will do better than any essentially different strategy in the long run (that is, over a span of time in which the observed fraction of bets that are successful equals the probability that any given bet will be successful). It was described by J. L. Kelly, Jr in 1956.[1] The practical use of the formula has been demonstrated.[2][3][4]

Where

p = Probability of winning

b = Net profit from a winning bet

Wikipedia also notes that if the equation returns a zero value the optimal bet is no bet and if a negative value is obtained then the prospective better should (if possible) take the other side of the bet.

Unfortunately this option isn't available for the just-dice website (making it more of a game than risk market) so before analysis even begins we already know just-dice is potentially not a good place to place bets (note on this at the end).

But let's push on and see what kind of numbers we get for the various values of p and b. This is a crude sensitivity analysis just to see if the data tells any obvious stories, the just-dice site should be commended for making a very nice betting site which is quite transparent in terms of showing you the parameters of each bet.

The analysis shows that there isn't much point pressing deeper into the data as it's doubtful we will see a positive f* value and as I mentioned earlier we cannot take the other side of these bets in the game.

Note: One cool thing about just-dice is that they allow you to "invest" in the house, i.e. your bitcoins get exposure to the house edge (according to their website, currently limited at 0.5% of the total 1% if my reading is correct).

The sensitivity analysis shows that for the chosen (and likely all possible) probabilities, the optimal bet is to take the house side of the bet, so the only optimal bet is to invest. Anyone playing the game should view it as a crapshoot or hobby at best.

The topic of when to invest in just-dice and when to withdraw is obviously an interesting one of itself and might form the topic of a later blog post, leave a comment if you'd be interested.

It took me about 1.5 hours to sail about the just-dice website, collate data and write this blog post. If you found it interesting and would like to encourage more postings of similar stuff, consider a 1.5h*BTC donation to

1CcaDNd7mso6PcCHLitZXGeRNdrCJrgx7u

Subscribe to:

Posts (Atom)